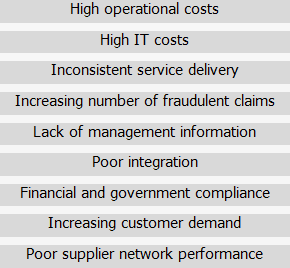

Understanding the challenges in claims management is the first step towards determining the means to meet them. The South African industry shares many of the global issues in claims management, but has a few challenges of its own – such as meeting TCF regulation. Service provision is an important part of the process and a determining factor in customer retention. The key issues that the British industry is facing are:

High operational costs

Caused by claims leakage, missed opportunities, erroneous payments (for example in cases of fraud), manual processes and so on. Anything that delays or disrupts the claims management process, can be viewed as an unnecessary operational cost.

High IT costs

Often a result of complex legacy systems and architecture. Outdated mainframe solutions are kept in place as replacing or unlocking them seems impossible without disrupting the business and incurring high costs up front. Large and costly IT departments spend their time on maintenance and user support.

Inconsistent service delivery

Occurs because of incoherent processes and lack of insight in data and task management. An inability to prioritize the next steps for each claim cause delays, inaccuracies, and manual decision making and calculation lead to random outcomes in identical cases, thereby adding to the unpredictability of claim handling costs and service provision.

Increasing number of fraudulent claims

A major issue facing the insurance industry worldwide. Opportunistic claimants as well as those with more malicious intent cause a heavy strain on claims management processes as time is spent on analysing fraud indicators and consulting databases. On top of time spent, payments made on fraudulent cases lead to misinformation and distortion in claim predictions as well as direct cost.

Lack of management information

This means that decision makers are often in the dark about the actual trends in their claims and how to act with foresight. In complex application environments, maintaining a data warehouse is a costly undertaking and reporting is generally not real-time or relevant to the daily operation. As a result, financial forecasting becomes a risk and fluctuations threaten the business.

Poor integration

Both with internal and external systems, this further escalates the complexity of insurer’s IT environments and contributes directly to many of the issues listed here. The main risk associated with poor data integration is working with outdated or incorrect data, affecting payment levels and customer satisfaction, not to mention the strain incurred on the IT department to correct and maintain integrations.

Financial and government compliance

Generally considered a necessity that sees more and more focus from stakeholders and the general public, as well as said financial and government institutions. New regulations such as TCF and SAM are being introduced and send a message of “shape up or ship out” to insurers. Needless to say, keeping up with such changing regulations when working with complex systems and processes is an exhausting enterprise and takes focus away from the core business.

Increasing customer demand

Which means that it is no longer sufficient to simply have your processes in place and benefit from them. Trends such as mobile and online claims management have entered the market from other industries and have now become the norm. As competition increases with smaller players and new concepts, customer retention is not only based on policy pricing and quality, but also on the claims management process as experienced by the client.

Poor supplier performance

Last but not least, this has an effect both on internal operations as well as the service levels perceived by customers. A lack of insight in the performance of suppliers and service providers such as repairers and damage experts creates black spots in the hand-off of the claims management process. Poor supplier performance may be caused by poor integration or data availability, as well as external causes which insurers should be aware of.